June 8th, 2025

The market has been somewhat volatile in the year to date, related to dramatic trade policy initiatives by President Trump. This volatility motivated me to optimize my portfolio holdings.

The policy changes in question centered on the abrupt imposition of large tariffs on imported manufactured goods, especially on the totalitarian Communist People’s Republic of China (PRC), but also on many other countries. This caused declines in stocks of companies which sell goods manufactured in the countries in question. For example, Apple, which sells iPhones primarily made in PRC, and Best Buy, which sells many products made in Asia, both declined.

This was a significant market decline, a correction (conventionally, a decline of at least 10% in the broad market is considered a correction) of about 19%, not quite a bear market (a market decline of at least 20% is conventionally held to indicate a bear market). The decline was very quick, over less than a month from the S&P500 peak of $6144.15 on February 19th, to the nadir of $4982.77 on April 8th. Apparently growing investor concern lowered the S&P 500 by 7.7% from the peak on February 19th, to the close on April 2nd. The index then dropped 12.1% from the close at 5670.97 on April 2nd, Trump’s declared “Liberation Day”, to the nadir 6 days later. So the bulk of the drop, and of the drama, occurred in the final week of the decline.

When a decline of this magnitude and speed happens, stocks of many companies, and values of other assets, fall, even if their value should not, from a strictly rational point of view, be affected by the factors that caused the market disturbance, in this case the tariff policies. This phenomenon of, “selling the good with the bad” occurs as investors succumb to fear, indiscriminately selling in order to avoid further loss of value. In addition, assets that have been relatively less affected by the inciting factors, must be sold to raise money to meet margin calls or other liability obligations, hence, the “good” must be sold as the “bad” loses its value. Hence, the selling tends to accelerate, as it were, once a certain trigger is reached.

Further, when market corrections occur rapidly, in the absence of tangible changes in economic conditions as indicated by data regarding recent economic activity, the market generally recovers as quickly, as investors subsequently take advantage of the inviting, lower prices of stocks.

Therefore, rapid market corrections, accompanied by the customary media and investor hysteria, in the absence of actual deterioration in economic conditions, are a stellar opportunity to buy companies which we wish we owned more of, at sale prices. It is important to note, that buying at this time requires acting in opposition to some people and possibly many, who are urging caution, at least until the market has recovered. Of course, by then, the sale prices have disappeared.

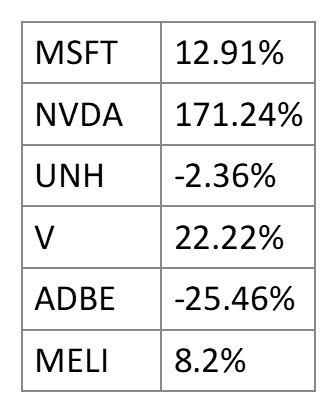

Accordingly, while President Trump’s abrupt approach to tariff policy has been quite hair raising at times, this set of conditions, as it developed in the week after Trump’s “Liberation Day” on April 2nd, stimulated me to reallocate funds to invest to more adequate levels in companies which have a great future. I sold United Health as it was relatively unaffected by the tariff policy changes. I moved funds from Microsoft and Visa to invest more in Mercado Libre and Nvidia. I even bought Palantir, before selling at a small gain, as I was not comfortable with its very high valuation. I also invested a relatively small amount in Arm Holdings.

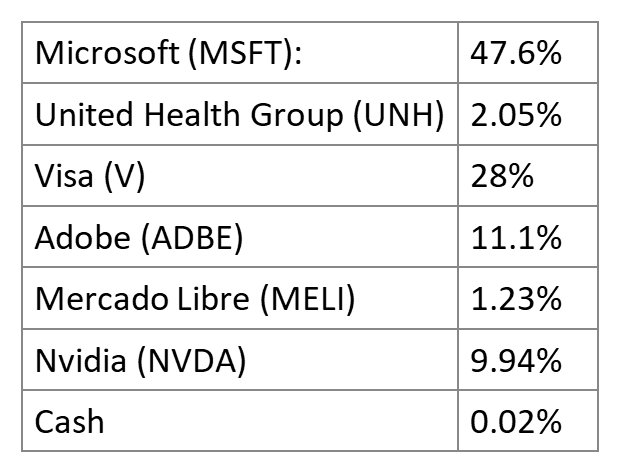

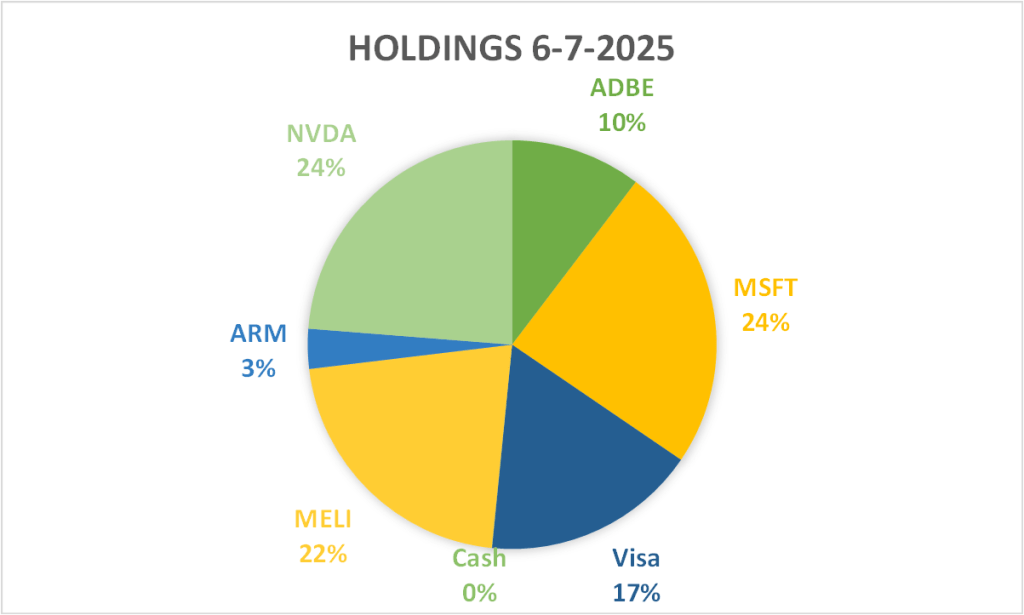

As of June 7th, my portfolio holdings are as follows:

I have increased allocation to the rapidly growing Mercado Libre and Nvidia. Previously I was probably too cautious regarding their relative volatility, failing to allocate funds to them even when they had declined by more than 15% from their 52 week high. Most importantly, in the context of the recent abrupt market correction, this was the opportune time to buy more. The small proportion allocated to Arm Holdings Plc. was made in view of the recent IPO, with very high PE. The PE was however, falling as revenue grows. Of course, Arm Holdings plc is not a new or untested company. It assumed a dominant market share in ARM chips over the last two decades. ARM chips are rapidly increasing in data centers which are key to the emerging AI related business economy.