Jan 10, 2025

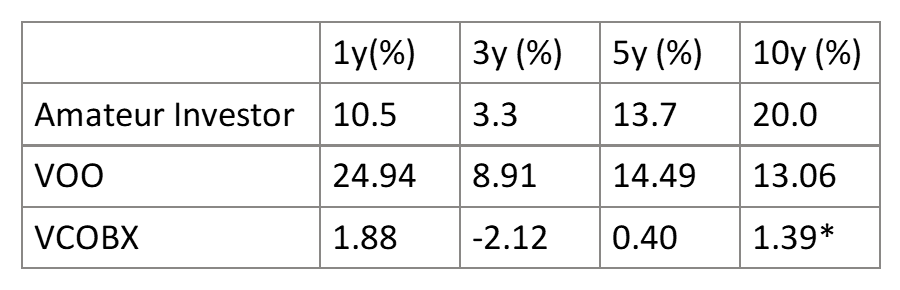

Annualized Performance (Internal Rate of Return) of Amateur Investor portfolio at 1y, 3y, 5y and 10y (%), as of the last trading day of 2024, is shows in the table below. Investors might be broadly grouped into those who pursue the future gains in value promised by operating businesses (stock investors), and those who prefer a formally guaranteed stream of income from asset backed securities (Bond investors). Therefore, I am comparing portfolio performance with the average annual return of securities of interest to Stock, and Bond investors. The S&P 500 broad US stock market index is represented by The Vanguard S&P 500 ETF (VOO). The diversified, investment grade bond market, including US Treasury, mortgage backed, and corporate securities, is represented by the Vanguard Core Bond Fund (VCOBX).

*note VCOBX Core Bond Fund inception was in 2016, so the provided 10-year annualized performance as of 12-31-2024 is that of the fund benchmark.

The S&P500 performed quite well in the past decade, bearing in mind that the average S&P500 return over the last 100 years is just over 10%. Meanwhile, the bond market has not performed as well. Interests rates remained quite low in the early part of the last decade, and subsequently climbed. In 2022, the rate of inflation rose in the US. The Federal Reserve took measures to increase interest rates to correct this inflation. At start of January 2022, rate was 1.637%. At end of December 2022, rate was 3.879%. Bond prices therefore fell. Bond investors began 2023 with a yield not seen since 2010. The bond market did recover somewhat. Meanwhile, investors in the businesses listed in the stock market were exploring growth related to digital transformation, which had been accelerated during Covid; the new focus on AI; and amazing advances in computer chips. Most investors found these prospects more inviting than the bond yields of just under 4%. Their renewed animal spirits raised the S&P500 index price by 24.23% in 2023, and 23.31% in 2024.

The S&P has not risen by over 20% for two consecutive years since 1997-1998, which was a very different time from the early 2020’s …. Come to think of it, the two epochs do share the advent of a transformative digital technology. Then, investors were enthused over the potential of the internet to drive business reach and productivity. Today, AI is poised to transform productivity. However clearly in the late 1990s the stock market was reaching into Mania territory, whereas I do not think that is the case currently…yet. But I digress.

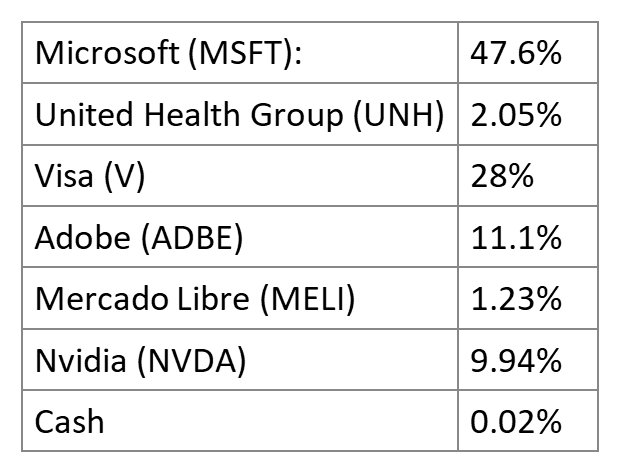

Amateur Investor portfolio holdings at end of 2024 are shown in the table below.

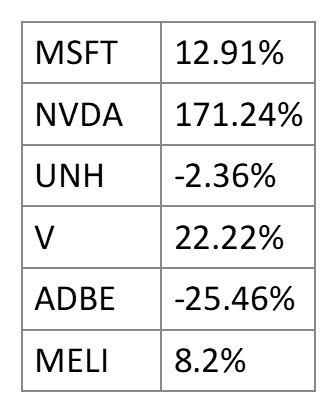

The price returns for 2024 of Stocks in the portfolio are shown in the table below.

Amateur Investor markedly under performed the market at 1 and 3 years, and slightly at 5 years. Microsoft makes up 47.5 % of the portfolio. Microsoft was the worst performing stock in the Magnificent 7 in 2024. Nvidia is the best performing Mag 7 stock this year, but made up only 5.4 % of the portfolio at time of purchase. It now accounts for 9.94 % of portfolio.

The fact is, because Amateur Investor did not contain most of the Magnificent 7 companies, it did not capture their performance. The Magnificent 7 companies’ overall strong performance was reflected in the strong S & P 500 return because they make up a significant portion of the S&P market capitalization and total return, accounting for fully 34.6% of the S&P 500 market cap as of June 2024.

There is no specific magic to the success of the Magnificent 7, it is simply a catchphrase for a group of companies which recently achieved the highest market capitalizations, and seem to be popular among investors. I find myself to be unable to heed the siren calls of trendy stock investments. I would rather understand whether and why the key characteristics of a particular business make it a candidate for my portfolio.

While Amateur Investor underperformed the broad stock market in recent years, it outperformed the S&P500 over 10 years. This shows that the portfolio companies, which over most of that time were MSFT, V and ADBE, are able to consistently grow revenue and earnings, without regard to membership in the club of in-vogue stocks. This is related to their competitive advantages, which include switching costs, economies of scale and network effects. The more recently added members of the portfolio, MELI, NVDA and UNH, have similar qualities which have been proven over decades of their history.

Things to be fixed:

Possibly the most significant error of this year was the failure to invest enough in NVDA. This resulted from a lack of consistent research about promising business opportunities in the market. I only recently learned about Nvidia’s history of anticipating, shaping and adapting to changes in its markets. It has invested massively to achieve this, over multiple decades. Thus, it has come to play a crucial role in the development of the computing power needed for modern business. It is important to consistently maintain reading habits regarding events in the market and the portfolio companies, while avoiding being drawn into speculative gambles.

Now that Mercado Libre has declined by almost 20% from its 52 week high, I will try to raise its allocation in the portfolio to closer to 10%, in exchange for some stocks that did well this year, such as Visa.

An issue with stocks such as MELI, NVDA and ADBE is their volatility. I feel more comfortable investing a relatively smaller amount with the stock was dropped by at least 15% from its 52 week high. Otherwise the volatility can create some anxiety which must be acknowledged.